|

You are here : Purchase > Purchase Masters > Tax Structure Master - Entry Tax Structure Master - Entry |

Add and maintain various Rate Structures through this master. Rate Structure Master allows to club one or more predefined Tax Rate which may be applicable for a particular Rate Structure. Rate Structure is used to calculate an Item’s landed price as per the contained tax slabs.

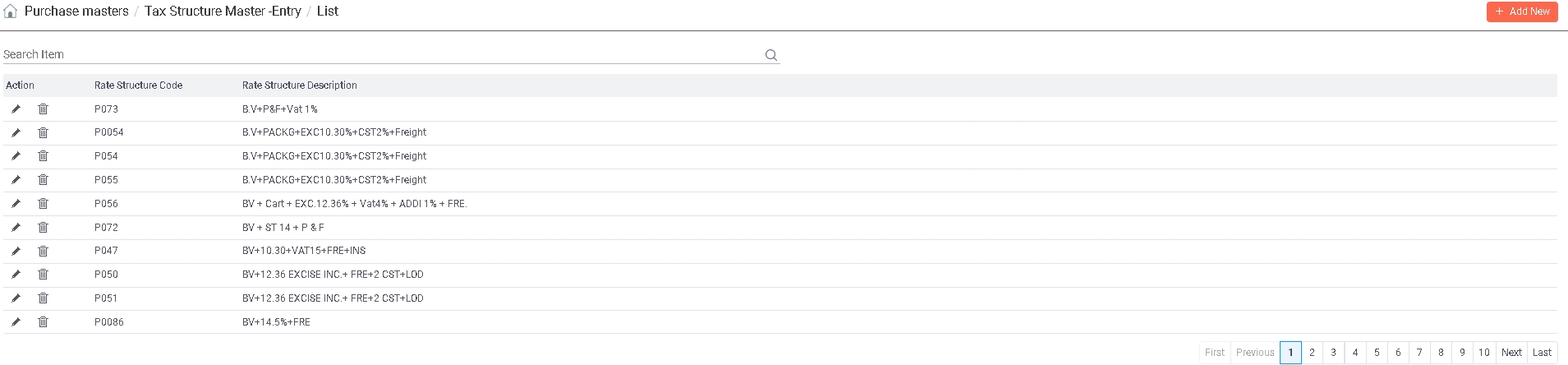

A list of already defined Rate Structures will be displayed as follows-

Enter any text you want to search in the list below. The search is applicable to all columns of the list. Once the text is entered, press <ENTER> key. As a result, the list will be refreshed with all those records that contain the entered text fully or partially. In order to go back to the original list, remove the text from the box and press <ENTER> key again.

Tax Structures can be added, edited, deleted and viewed provided the Role associated with the currently logged-in user through User Management has the respective rights to do so.

Tax Structures can be added, edited, deleted and viewed provided the Role associated with the currently logged-in user through User Management has the respective rights to do so.

To 'Add' a Tax Structure, click on the ![]() button and to 'Edit', click on the

button and to 'Edit', click on the ![]() icon on its corresponding record. Click on the

icon on its corresponding record. Click on the ![]() icon to delete a particular Tax Structure. To view details of a particular Tax Structure, <DoubleClick> on that record. As a result, following screen will be displayed -

icon to delete a particular Tax Structure. To view details of a particular Tax Structure, <DoubleClick> on that record. As a result, following screen will be displayed -

You can not 'Edit' or 'Delete' a Rate Structure if it is being used in Item Vendor Purchase Master.

(Type : Alphanumeric, Length : 5)

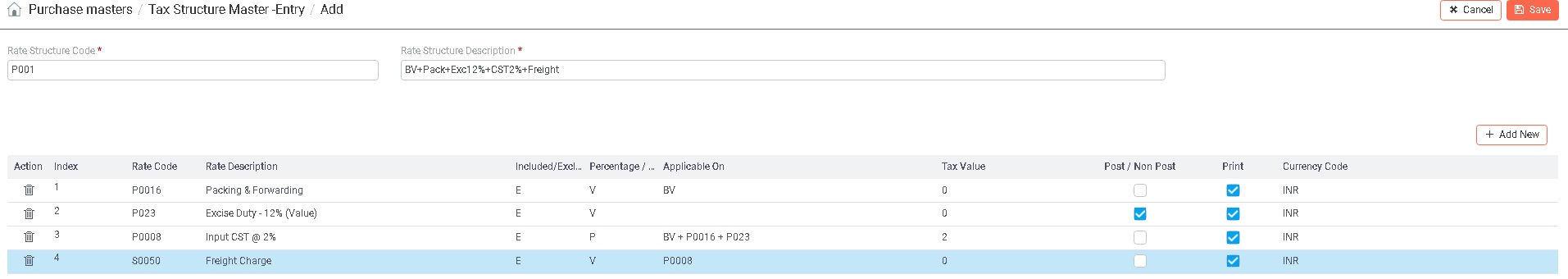

In case of 'Add', enter the new unique Structure Code. This is the Code by which a Rate Structure will be referred through out IMMS.

In case of 'Edit', and 'Search', Rate Structure Code will be displayed for the selected record. You can NOT change it.

(Type : Alphanumeric, Length : 60)

Enter the Description of the new Rate Structure Code.

Next a grid will be displayed as follows -

While 'Adding' a new Rate Structure, this grid will be displayed as blank.

In case of 'Edit', and 'Search', this grid will be populated with all the Tax Rates belonging to the selected Rate Structure.

Click on the ![]() button to add new Tax Rate. A new row will be added in the grid.

button to add new Tax Rate. A new row will be added in the grid.

Field Description of the grid -

Action

Click on the

icon to remove a record from the grid. Click on the 'Delete' icon again to un-delete the record.

Index:

System generated sequence number.

Rate Code:

Denotes the Rate Code that belongs to the selected Rate Structure.

Click on the field to access a list of Tax Rates defined through Tax Rate Master - Entry option. Select your desired Tax Rate from the list by scrolling down to it and pressing <ENTER>. Press <TAB>.

Please note that -

- Rate Code having Tax Type as CGST, IGST, SGST and UGST can appear only once in one Rate Structure. IMMS will check for their repetition and display an appropriate message informing the same

A Rate Structure can not have combination of (CGST or SGST) and IGST

Rate Description:

Description of the selected Rate Code will be displayed automatically for your reference.

Included/Excluded:

Automatically displays whether the selected Rate Code is Included or Excluded as specified through Tax Rate Master - Entry option for your reference. It can NOT be changed.

Percentage/Value:

Automatically displays whether the value of the selected Rate Code is in Value or Percentage as specified through Tax Rate Master - Entry option for your reference. It can NOT be changed.

Applicable On:

Denotes the Rate Codes on which this particular Rate Code is applicable.

Please note that this field will be enabled only in case -

- the selected Tax Rate is of 'Percentage' type.

- the selected Tax Rate is not 'NO TAX'.

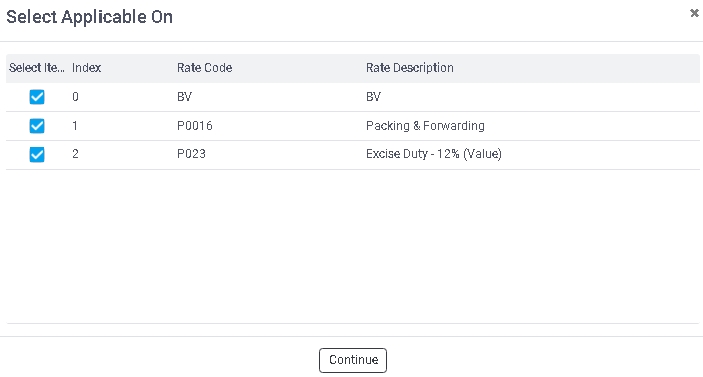

In 'Add' mode or while adding a new Rate Code in the grid, click on the field. Following screen will be displayed as a result -

A list of all previously added Tax Rates in the same grid will be displayed along with 'B.V.' (Basic Value). Select the Tax Rates on which the selected Tax Rate is applicable by clicking on the small white box. You can click the box again to de-select it.

Once done, click on 'Continue' button to continue. As a result the control will go back to the grid and the formula will be displayed automatically depending upon the selected Tax Rates .

In case of 'Edit', and 'Search', 'Applicable On' will be displayed as per the selected Rate Structure Code. You can NOT change it in 'Edit' mode.

Tax Value:

Automatically displays the Value of the selected Rate Code as specified through Tax Rate Master - Entry option for your reference.

It can be changed in 'Edit' mode if -

- the selected Tax Rate Code is of 'Value' type.

- the selected Tax Rate Code is of 'Percentage' type but its Value specified through Tax Rate Master - Entry option is zero.

Post/Non post:

Automatically displays whether the selected Rate Code is Postable or Non Postable in Purchase as specified through Tax Rate Master - Entry option for your reference. If it is Postable, the box will be displayed as checked otherwise it will be displayed empty.

You can change it in 'Edit' mode provided the selected Rate Structure has not been used in Item Vendor Purchase Master.

Print:

Click on the small white box if you want the particular Tax Rate to appear in all the concerned reports such as Purchase Order, Invoice, Challans and many more. Click on it again to de-select it.

If this box is kept empty, the particular Tax Rate will NOT appear in any of the reports.

Currency Code:

Automatically displays the Currency of the selected Rate Code as specified through Tax Rate Master - Entry option for your reference. It can not be changed in 'Edit' mode.

Once you have entered all the information, click on 'Save' button to save or 'Cancel' button to discard. The control will go back to the list.

|

Please note that while saving the Rate Structure, IMMS will check the following -

|